Picture, if you will, a US-focused senior consultant at a global professional services firm. You are one of as many as 100,000 staff in your market, part of a multi-billion dollar business line, tasked with parsing complexity for clients, and creating a path forward. For the sake of storytelling, let’s call you Nate Bateleur.

What's Happening in Energy highlights the most interesting findings from public utility commission filings.

Subscribe below to get these insights delivered straight to your inbox:

What's Happening in Energy — June 6

Powered by Halcyon

__

We recently shared word of East Kentucky Power Cooperative’s newly proposed data center tariff. Now, there is a new request to intervene from an important (notably, non-data center!) entity: steelmaker Nucor. Its reasoning is worth quoting in full:

"Nucor’s intervention is likely to present issues or develop facts that will assist the Commission in fully considering the matters at hand. EKPC’s proposed data center tariff is a complicated, precedent setting filing which if not approved could adversely affect the rates paid by all end use customers served by EKPC, including Nucor. Nucor is by far the largest single user on the EKPC system, and is one of the largest users of electricity in the United States. Nucor will be a helpful and active participant should its intervention request be granted.”

Docket profile

Request to intervene

__

Florida Power & Light’s proposed $10 billion rate increase is under discussion. Naturally, this is a large complex rate case proceeding involving extensive discovery with 582 interrogatories already served, nine customer service hearings scheduled, and over 300 customer comments received so far (like the one comment below). Check out the other comments, as well as the adjustments FP&L is proposing.

Docket profile

Docket profile

Proposed base rate adjustments

__

It’s summer preparedness season, and in Iowa, utilities including Interstate Power and Light Company, Missouri River Energy Services, Iowa Association of Municipal Utilities, and others submitted their summer 2025 preparedness and grid resilience plans. Specific focus? Peak load and extreme weather events. Iowa’s reporting follows ongoing concerns about electric reliability in the MISO region, particularly in light of the North American Electric Reliability Corporation's 2024 assessment that identified the MISO region as high risk for energy shortfalls.

Docket profile

__

Bear Valley Electric Service in California has a special place in Halcyon lore (a story for another day). In its recent filing, BVES states its reliability figures, which look …not great, but it also argues that it is unreasonable to assign zero reliability value to its solar energy and battery storage projects.The reasons are due to major events which it did not control:

“2025 SAIDI numbers are already over double the 2022 total numbers even though we are only in May of 2025. The 2025 numbers are due to major events such as the SCE Public Safety Power Shutoff that occurred earlier in the year (compare the 2022 SAIDI value of 272.40 to the current 2025 SAIDI value of 640.06 in the table below). These types of events are outside of BVES’s direct control.”

Docket profile

Rebuttal testimony

__

Get your renewable energy (really) cheap in Wyoming. In its annual update to its Renewable Energy Rider Program, Montana-Dakota Utilities’ requested and received approval to decrease the charge per 100 kilowatt-hour block of renewable energy from $0.22 to $0.01, effective June 1, 2025. So, the intangible attributes of a megawatt-hour of renewable energy are worth…a dime.

Docket profile

Filing

__

In Washington State, PacifiCorp says that it will meet its 2025 Renewable Portfolio Standard (RPS) of 15% with ample room to spare. That’s partly a function of more qualifying resources (almost 200,000 megawatt-hours more) but also lower retail sales (about 80,000 megawatt-hours less).

Docket profile

RPS Report

2025 Renewable Report Workbook

__

In Florida, an almost final Flexible Gas Service (FGS) tariff applicable to large industrial Florida City Gas (FCG) customers with alternative fuel or bypass options, would allow negotiated service agreements without requiring individual FPSC approval.

Docket profile

__

A wind project in Ohio is shrinking. The Ohio Power Siting Board received the third amendment to Firelands Wind LLC’s Emerson Creek Wind Project. In 2021, the Power Siting Board authorized up to 71 wind turbines with a maximum nameplate capacity of 297.7 megawatts. Thanks to landowner feedback and environmental impact concerns, it’s now down to 49 turbines. Here is a handy table of Emerson Creek’s newly reduced footprint:

Ohio Power Siting Board Staff Report

Ohio Power Siting Board Staff Report

Docket profile

__

Data centers in Michigan — but not the way you think. Consumers Energy Company is migrating most of its IT data center to cloud-based services, stating increased cloud capabilities offer several advantages, including the ability to scale capacity, pay only for resources that are used, and avoid capital investment and O&M. Accordingly, its IT hardware investment expectations are down quite a bit. (And yes, the full direct testimony is 1,664 pages.)

Docket profile

Direct testimony

__

Last week we brought you SWIFT’s concerns about signal interference from power assets in Virginia. This week, it’s Ohio’s turn: a spectrum conflict between internet service provider New Era Broadband, LLC and AEP Ohio regarding AEP’s Advanced Metering Infrastructure (AMI) use of frequency-hopping radios in the 902-928 MHz band. New Era suggests that if the AMI is fully built out, the conflict will render their 900 MHz links inoperable.

Docket profile

Request for PUCO engagement

What's Happening in Energy — May 30

Powered by Halcyon

__

A look into one utility’s cost savings justifications after an acquisition: Accenture proposed cost savings via an “IT transition plan” as part of Saturn Utilities Holdco’s proposed plan to buy New Mexico Gas Company from Emera.

Docket profile

Accenture’s IT transition plan (p.34)

__

Not a utility or state regulator, but interesting nonetheless: Southwest Power Pool’s regional transmission operator Expansion Integration Study identifies potential reliability issues and a power system simulation.

RTO Expansion Integration Study (and .ppt)

RTO Expansion Integration Study (and .ppt)

__

Neighboring RTO Midcontinent Independent System Operator has updated its MISO-SPP 2024 Coordinated System Plan (CSP) to enhance interregional planning by monitoring the eastern interconnection, focusing on the southern seam of MISO and SPP, which includes Oklahoma, Arkansas, Texas, and Louisiana. The study seeks to identify transmission upgrades to improve reliability and resiliency, which is particularly relevant given Louisiana’s recent system issues.

MISO-SPP 2024 CSP Study Update

__

Back to Kentucky, where data center activity does not let up: the East Kentucky Power Cooperative proposes a new tariff called Rate DCP - Data Center Power. Eligible Data Centers are defined under Rate DCP as meeting two criteria: load size (15 megawatts (MWs) or greater) and load factor (60% or greater). Many features worth noting but in particular: data center loads exceeding 250 MWs will require “one or more dedicated resources” — that is, they need to bring their own power, or contract for it. Docket profile

Proposed tariff filing

__

If you live in North Dakota and own the land being used for the 200 megawatt Oliver Wind IV Energy Center’s transmission line effort, you can waive and refuse the option to have trees and shrubs on your property/right-of-way replanted.

Docket profiles PU-23-317 and PU-23-318

Filing: Tree and Shrub Mitigation Plan and Supplement

__

A somewhat dramatic finding from Georgia Power’s Integrated Resource Plan and Demand Side Management Plan: the state has almost no interconnection capacity in 2027, even less in 2030, and no transmission capacity to connect its best solar areas from GIPL and Southface’s demonstrative handout).

Docket profile: DGA Power Cert, De-Cert, and Amend Demand Side Mgt Plan

__

It’s Halcyon’s weekly “wow, that’s a big rate increase request” for water utilities: Arizona’s Joshua Valley Utility is asking for an additional $308,773, or 73% of total revenues (!) “due to operational losses and increased expenses for system repairs and improvements.”

From Joshua Valley Utility’s application, “Since 2014 the potable water industry producer price index has increased 96%.”

And from a telephone comment,

“This company was recently acquired by a utility owning division. The last owners had 4 employees and were able to be profitable. They are down to 2 employees now. JVU decided to install a very expensive generator project locally even though our electric company Unisource, provided one in an emergency.”

Docket profile

Rate application

__

In Wisconsin, application documents for the Mill Road-Granville Transmission Line Project include not just wire plans but also tree clearing, bat maternity seasons, and confidential redacted information about avian deterrence. The responsibilities of the wildlife rehabilitation specialist placement of nesting platforms is confidential, and redacted.

Docket profile

Data request response

__

Also in Wisconsin: A helpful itemization of costs for the $166.1 million, 92 megawatt Red Barn Wind Energy Center.

Docket profile

Final cost report

__

And if you’ve read this far — my favorite of the week, in Virginia: SWIFT (the Society for Worldwide Interbank Financial Telecommunication) filed a notice of participation in a Virginia certificate for public convenience and necessity hearing for transmission lines in Culpeper County. Its reason is fascinating: SWIFT’s engineers advise that electromagnetic field (EMF) emissions from either of the foregoing two routes of high powered 230 kV transmission lines may significantly interfere with SWIFT’s global operations.

That is: too much electromagnetic emissions, and your wire transfers won’t be transferring.

Docket profile

Notice of participation

What's Happening in Energy — May 23

Powered by Halcyon

__

In California, SoCalGas has identified its customers that could benefit from behind-the-meter microgrids. It identified…76,000 potential microgrids in its service territory. Total built to date: 54.

Docket profile

Prepared direct testimony

__

In Missouri, a now-familiar occurrence: recent resource plans are being tossed out thanks to soaring potential demand from data centers. In 2023, Ameren expected zero megawatts of data center load and almost one gigawatt of energy efficiency and demand response in its future; it now expects 2.5 gigawatts of data centers and less than 300 megawatts of efficiency and demand response. The result? An increase in aggregate peak demand of nearly three gigawatts.

.png?width=700&height=532&name=MO_Ameren_T3.3ChangeinCapacityPosition-NewPRPv.PriorPRP%20(1).png) Docket profile

Docket profile

Filing

__

Related, also in Missouri: Ameren’s analysis finds that in its service territory, battery energy storage systems are more economic on a capacity equivalent basis than natural gas simple turbines up to 1,500 megawatts of capacity. Quote:

“As Table 2 shows, BESS is more economic than additional NGSC (i.e., beyond that already included in the PRP) on a capacity equivalent basis up to 1,500 MW of BESS additions for Ameren Missouri (the negative numbers in the last row of Table 2 reflect a reduction in net present value of revenue requirement over the planning horizon).”

Docket profile

Direct testimony

__

A collage of central Maine Power’s March 7 wind storm: Almost 25,000 accounts without power at peak, and one day, 11 hours, and 41 minutes of time required to restore service.

__

It’s not often we see territorial disputes between power utilities, but here’s one in Florida: a petition by Taiquin Electric Cooperative, Inc. to resolve a territorial dispute in Gadsden County with the City of Quincy. Small dollars, but a fascinating process nonetheless.

Docket profile

Docket profile

Response to data request

__

In Idaho, utility Avista has proposed a 14.7% increase in residential electricity rates this year, followed by a 5.3% increase in 2026. A comment from a ratepayer:

I am not a numbers man but the proposed increase in electric and natural gas appears perverse and potentially detrimental to those they serve

Docket profile

Comment

__

Not to be outdone in Ohio: Christi Water System proposes a 30.51% rate increase (not a typo). From testimony from the OH Consumers' Counsel there is between a 30% and 48% unaccounted-for water loss percentage, and testimony from the PUC's rates and analysis department to support the Joint Stipulation and Recommendation. The Ohio Consumers' Counsel's argument is that while inflation is hitting basic goods and services, this utility rake hike is rather different.

Docket profile

Direct testimony

__

Georgia has five large battery storage projects under development, with a total about 750 megawatts and 2,500 megawatt-hours of capacity and energy. All five are expected to commission between May and November of next year. Georgia Power is using Tesla Megapacks for its storage capacity.

__

We’ve covered Kentucky and an ongoing certificate of public convenience and necessity hearing to accommodate economic activity in our blog post this week. A nugget from supporting filings: the significance of the utility’s expected change in demand with economic development…and the total lack of change (or rather, the slight decline in demand) without it.

__

In Pennsylvania, data center development is moving quickly. In August, 2024, utility PPL said that it had five gigawatts of data centers in advanced stages of approval (source, p6). In May of 2025, that figure is already 11 gigawatts (source, p36). Total active requests have increased from 17 gigawatts of potential projects through 2033, to 50 gigawatts by 2034.

What's Happening in Energy — May 16

Powered by Halcyon

__

Data centers! Pennsylvania has convened an en banc (read: every commissioner at once) proceeding on large load interconnection (read: data centers) in the state. For anyone following, shaping, or helping decide the future of large loads in the US electric system, here is a great set of questions posed by the PA PUC following the thoughtful en banc hearing that happened 3 weeks ago:

- Docket profile

- Statements from Data Center Coalition, PPL Electric Utilities, First Energy, Duquesne Light Company, PECO Energy Company, Vantage Data Centers, and more.

- Key quotes from the utilities: a single new data center could be 30% of peak load in Duquesne Light’s service territory, and four projects in advanced stages in PECO’s service territory could add 40% to its demand.

__

In Wyoming, Black Hills Energy requests a 1.43% rate increase in order to cover its Carbon Capture Compliance surcharge: that’s an additional $4.7 million for 45,753 customers.

Docket profile

Application

__

Also in Wyoming: Montana-Dakota Utilities Co. and the Wyoming Office of Consumer Advocate (OCA) are waiting for approval of an average 11.68% rate increase effective August 1. Rates table below - the 15.46% average increase falls heavily on residential ratepayers.

Docket Profile

Stipulation and Agreement

__

Also out West: in Utah, the Salt Lake City Corporation is concerned about Rocky Mountain Power’s “unprecedented drop in avoided cost prices,” and that it will impair further development of new power assets. Relatedly: the Corporation is concerned that the new cost structure does not incorporate tariff impacts.

Filing

__

An Antora energy storage project in South Dakota has received a state grant for its $200 million+ thermal energy storage project, Big Stone Energy Storage Project LLC (also receiving a grant: an “international cheesemaker”). That’s April news. Here’s what to watch: its 1-of-1 tariff being established with utility Otter Tail.

Docket profile

__

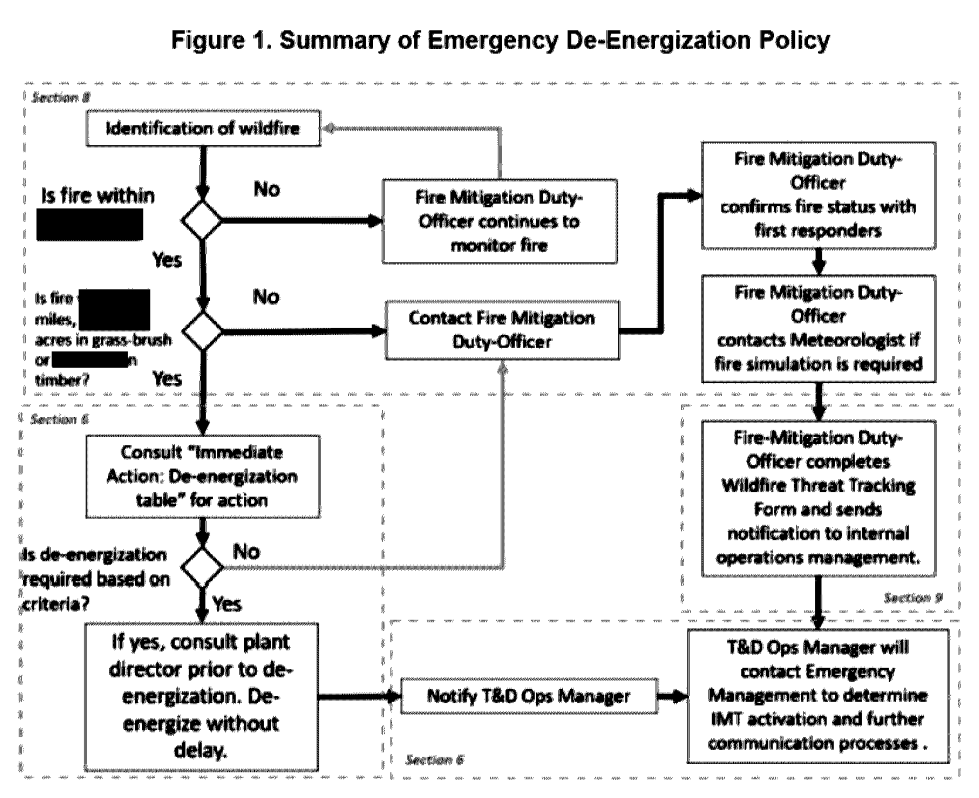

In Nevada, NV Energy filed the first amendment to its 2024-26 Joint Natural Disaster Protection Plan, requesting an order accepting this first amendment by June 13. Here’s a cool flow chart of how it de-energizes in the event of a wildfire (note: redactions are within the document itself).

Docket profile

__

From the Southwest: Southwestern Public Service Company’s $538 million “Texas Resiliency Plan 2025-2028.” Of that plan: $521 million is capital investment, and $345 million of that is distribution resiliency.

__

Kentucky solar development plans have a 250 megawatt hole: AEUG Mason Solar (a subsidiary of Spanish company Acciona) is withdrawing its application to build a merchant solar+storage project in the state.

How do we know this is an Acciona development? This 2021 Notice of Intent to File Application of AEUG Mason Solar, LLC for Certificate of Construction with an Acciona email address for the filer!

Docket profile

Order

__

A tidbit in Hawaii: the Public Utility Commission is decreasing oversight of Hawaii Gas’ capital expenditures by increasing the oversight threshold from $500,000 to $2.75 million. That $500k figure “has not increased in 60 years to account for inflation and rising project costs” (!).

Docket profile

Decision and Order

__

And lastly in Virginia: this week was the deadline for testimony for an Appalachian Power Company (APCo) shared solar program. An interesting argument by Karl R. Rábago: that “APCo’s excessive and confiscatory proposed interim minimum bill will do irreparable harm and should not be approved.” His suggestion: a monthly minimum bill in the amount of $8.96 per customer including a fixed customer charge and $1 of placeholder administrative cost recovery.

Other perspectives include Staff of the Virginia State Corporation Commission pre-filed testimony Part A and Part B, various Memorandum submitted to the Commission, and the Coalition for Community Solar Access (Coggeshall and Kshemendranath) suggesting the minimum bill should be $0.

Stay tuned for the Evidentiary hearing on June 9th!

Docket profile

What's Happening in Energy — May 9

Powered by Halcyon

__

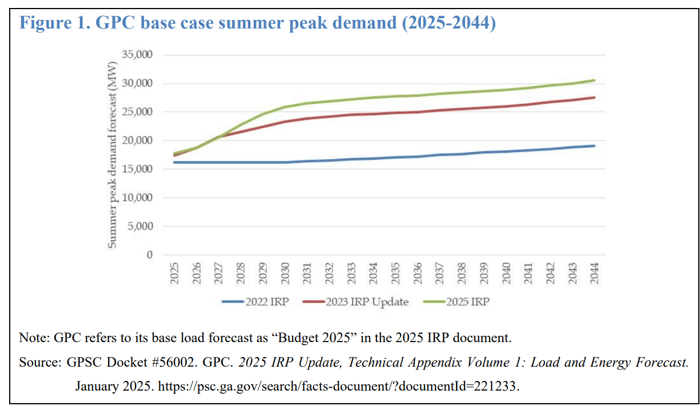

In Georgia, intervenors are concerned that Georgia Power's integrated resource plan may be over-stating data center load. Here are not one, but five great exhibits:

First: 2022, 2023, and 2025 base case summer demand

Second: contracted, service-requested and under-reviewed data center demand in gigawatts

Third: Additions and subtractions to the data center queue in Q4 2024

Fourth: Georgia Power says that it will need 9.4 gigawatts of new capacity by 2033…

…while regulatory staff say the figure is only 6 gigawatts.

__

In Nevada, a brand-new docket: data center operator Switch is building a new 345kV transmission line to serve its project needs.

Docket profile

__

In Colorado, Xcel has received approval for a $2.55 million ‘Thermal Energy Network Pilot Development’ development site.

Filing

__

There are rate increases, and then there are rate increases. The California Water Service Company is seeking an additional $140,558,101 or 17.1% in test year 2026. Water, not power, but still.

Docket profile

Transcript

__

Puget Sound Energy in Washington has kicked off a new power cost adjustment proceeding. See the table below for new supply contracts ‘requesting prudence,’ as well as PSE’s approved risk policy and management framework for hedging practices to help align with wholesale market conditions.

__

Some real inside-baseball stuff in Hawaii: the state commission seems to be moving past performance-based regulation of Hawaii Electric’s target revenues in favor of a full-scale traditional cost-of-service rate case that could result in re-basing its target revenues.

And some…differing perspectives from Hawaiian Electric Company, Ulupono, Blue Planet Foundation, and the Consumer Advocate.

Blue Planet Foundation, for instance, wants to reward the utility for achieved performance along this greenhouse gas emissions path.

__

The state of Wisconsin is reviewing Wisconsin Power & Light’s fuel cost and rates plans. A new group of intervenors has just landed, including Walmart. Why does Walmart care?

Walmart is a large commercial retail customer of Wisconsin Power and Light Company ("WPL" or "Company") owning and operating approximately 18 retail stores, two distribution centers, and related facilities within the Company's service territory. WPL delivers over 83 million kWh of electricity annually to Walmart, mostly under the Company's Industrial Power at Primary or Secondary Voltage – Time of Use ("Cp-1") rate. WPL delivers over 1.5 million therms of natural gas annually to Walmart, mostly under the Company's Medium Commercial & Industrial 20,000 – 200,000 therms ("GC-3F/I") rate. Energy costs comprise a large portion of Walmart's operating costs. As a result, Walmart would be directly impacted by: (1) the adoption of the Company's rate increase request, and (2) any rate design and ratemaking changes approved in implementing any approved increase.

Docket profile

Request to intervene

__

In Texas, Engie's application for its Antlia 70 megawatt battery energy storage project is also deficient, and the company has until May 22 to cure its deficiencies.

Docket profile

Finding

__

Also not a state (rather, an RTO): the Federal Energy Regulatory Commission has determined that Southwest Power Pool’s submitted revisions to its Open access Transmission Tariff to establish separate winter and summer planning reserve margins is deficient, and requires more information. Docket profile

Deficiency Letter

__

Alabama Power is considering the acquisition of the 1,189 megawatt Lindsay Hill combined cycle gas plant for reliability reasons. One of its latest depositions (highly redacted) points to the main driver of new demand: data centers.

Docket profile

Docket profile

Deposition transcript (data center bit starts on page 9 of 113)

What's Happening in Energy — May 2

Powered by Halcyon

__

This Colorado docket on its integrated resource plan is full of demand expectations and cost estimates from other US electricity markets (Docket profile). Of note: this February testimony in Kentucky on gas power plant prices (Document) and this presentation from Indiana Michigan Power on its demand growth expectations (Document). Here’s the heart of it:

__

In Ohio, FirstEnergy’s current rate case “has produced approximately 370,879 documents consisting of approximately 764,244 pages” of documents since February 21, 2024.

Docket profile

Filing

And incidentally of interest: one issue in the rate case is about the improper use of ratepayer funds to re-name a sports stadium!

Filing

__

Also in Ohio, The Williams Companies is planning to build, own, and operate two 200-megawatt gas plants to sell power directly to a [redacted] company. Here’s a useful overview on the project cost ($0.7 billion) and its economic benefits:

Document

Docket profile

__

In California, Pacificorp has begun proceedings on its wildfire expense management account. Watch this space: for now it is a lot of data requests and responses, but more meaty stuff will appear later. Docket profile

__

This proceeding in Louisiana — about Entergy gas plants built largely to serve the demand from Meta's enormous new data center — is a master class in redaction. Check out this testimony from page 7 and forward.

Filing

__

In Virginia, Halcyon favorite Rappahannock Electric Cooperative is kicking off a discussion on large load tariffs (read: data centers), with plans to implement by July 1.

Docket profile

Order for Notice and Comment

(I particularly like this one set of comments, one of which begins with "I used ChatGPT to help me with my comment".)

Document

__

Florida power utilities are kicking off their 2026-2035 Storm Protection Plans. Worth checking out (and following!) these dockets as they develop:

- Florida Power & Light (Docket profile)

- Duke Energy Florida (Docket profile)

- Tampa Electric Co (Docket profile)

__

In Missouri, we return to Evergy's integrated resource plan and a rebuttal on its gas price forecasts (too low) and its assessment of battery energy storage (too conservative).

Docket profile

Filing

__

In South Carolina, Duke Energy Carolinas submitted an ex parte brief on it to the Public Service Commission on its merger with Progress Energy, entitled "One Utility". Here's a chart purporting to show balancing operations, though without any X or Y axis units labeled.

Presentation

Docket profile

What's Happening in Energy — April 25

Powered by Halcyon

__

Georgia Power Company’s 2029-31 all-source capacity request for proposals has been underway since July of 2023. Check out Halcyon’s AI-powered Docket profile and also, this new document with seven (!) pages of Georgia Power staff evaluating the RFP.

__

In Florida, Duke Energy has calculated the cost savings of four solar projects, as compared to natural gas-fired power. Quote: “These project’s plants will all provide fuel savings…Based on the cost per kWh of natural gas in DEF’s 2025 fuel projection filing.”

__

A useful docket in Maryland for monitoring the state’s implementation of FERC Order No. 2222. Lots of detailed filings on what distributed energy resources are being proposed, built, and approved across different utility service territories.

Docket profile

Pepco 2024 Small Generator Interconnection Report

__

Also in Maryland, leaky gas pipes! Montgomery County in particular is on track for a record year for gas coupling leaks (by count) in Montgomery and Prince George’s County.

Docket profile

Filing

__

Worth watching in Michigan: Consumers Energy has filed an application to add a “data center provision” to its tariff sheets. You can guess how the Data Center Coalition thinks about it. September 16 is the deadline for the fully developed record in the proceeding.

Docket profile

__

Also data center-related, in Nevada: Callisto Enterprises LLC (Google) is seeking an energy supply agreement with NV Energy. Fervo’s Corsac project is supplying the project. Of interest at the moment? The utility is revising its pricing model, but its details will be kept confidential for at least five years following the termination of its agreement — so, two decades from now.

Docket profile

Supplemental Direct Testimony

__

In Arkansas, Southwest Electric Power Co has applied to set new electricity rates. The case is suspended (in the normal, not-an-issue way) while the commission’s staff reviews for at least 30 days. You can follow this rate case here:

Docket profile

__

Not big dollars, but a big % move: in Iowa the city of Johnston wants to apply a 5% surcharge on utility MidAmerican’s gross revenue from the sale of electricity and distribution services within the city’s corporate limits.

Docket profile

Ordinance

__

Two more Texas Energy Fund projects have fallen out of the application pile. The latest two? Application 131 (Emberclear Management and Jupiter Island Capital) and Application 122 (Frontier Group) are out because they did not meet the state’s due diligence requirements. Worth reading the entire summary.

Docket profile

__

A (gas) rate case in Virginia: Southwestern Virginia Gas Company has requested an overall increase in annual operating revenue of 6.3%. The State Corporation Commission “does not oppose the company’s request to implement its rate increase on an interim basis.” Read the document and docket for more — small overall numbers, but it’s the rate, and the award, that matter.

Docket profile

Filing

What's Happening in Energy — April 18

Powered by Halcyon

__

In Missouri (new state!), Evergy has issued a substantial update to its 2024 triennial integrated resource plan. The basics: load growth, a lot of it, for the first time in more than a decade, and most (if not all) of it from a single large customer. It’s noteworthy enough that I made a chart:

__

Also in Missouri, and not coincidental, is a new-ish application from Evergy “for Approval of New and Modified Tariffs for Service to Large Load Customers.” Plenty of data center operators are weighing in.

Docket profile

__

A rarity (these days) in another newly-covered state, Nevada: a utility (NV Energy) is lowering rates (for natural gas).

Docket profile

Filing

__

Another new state! Wisconsin — where proceedings to approve or deny a 1,100 megawatt gas combustion turbine project are underway. Not shown here, but indicated through repeated references to large load customers — another factory- or data center-driven grid expansion.

Docket profile

__

In Oregon, Portland General Electric has filed its 2026 annual power cost update tariff. Here is the kickoff document (236 pages).

Docket profile

__

Still in the Pacific Northwest: another Washington utility, NW Natural Gas, tackles the accounting required for tariffs on Canadian natural gas imports.

__

The Arizona Electric Power Cooperative is raising $94 million in long-term financing. This is a new proceeding, so you can follow it from the start at the Docket profile or jump right into the 352-page Application document.

__

Also in Arizona, the Columbia Electric Cooperative has opened a proceeding to revise its net metering tariff to include batteries. Not the world’s biggest electric system, but worth reading to see how much has changed since the tariff was established in 2010.

Docket profile

Filing

__

A useful docket in Virginia concerning data center-driven electricity rate increases. Hundreds of comments filed in the past week!

Docket profile

__

And lastly in New York State, a transcript worth reading on Consolidated Edison’s contentious rate case.

Filing

Subscribe below to get these insights delivered straight to your inbox:

Comments or questions? We’d love to hear from you - sayhi@halcyon.eco, or find us on LinkedIn and Twitter

.png?width=50&name=34C0AE28-DE08-4066-A0A0-4EE54E5C1C9D_1_201_a%20(1).png)

.png?width=1488&height=576&name=GA_GPC_BESS_projectlist%20(1).png)